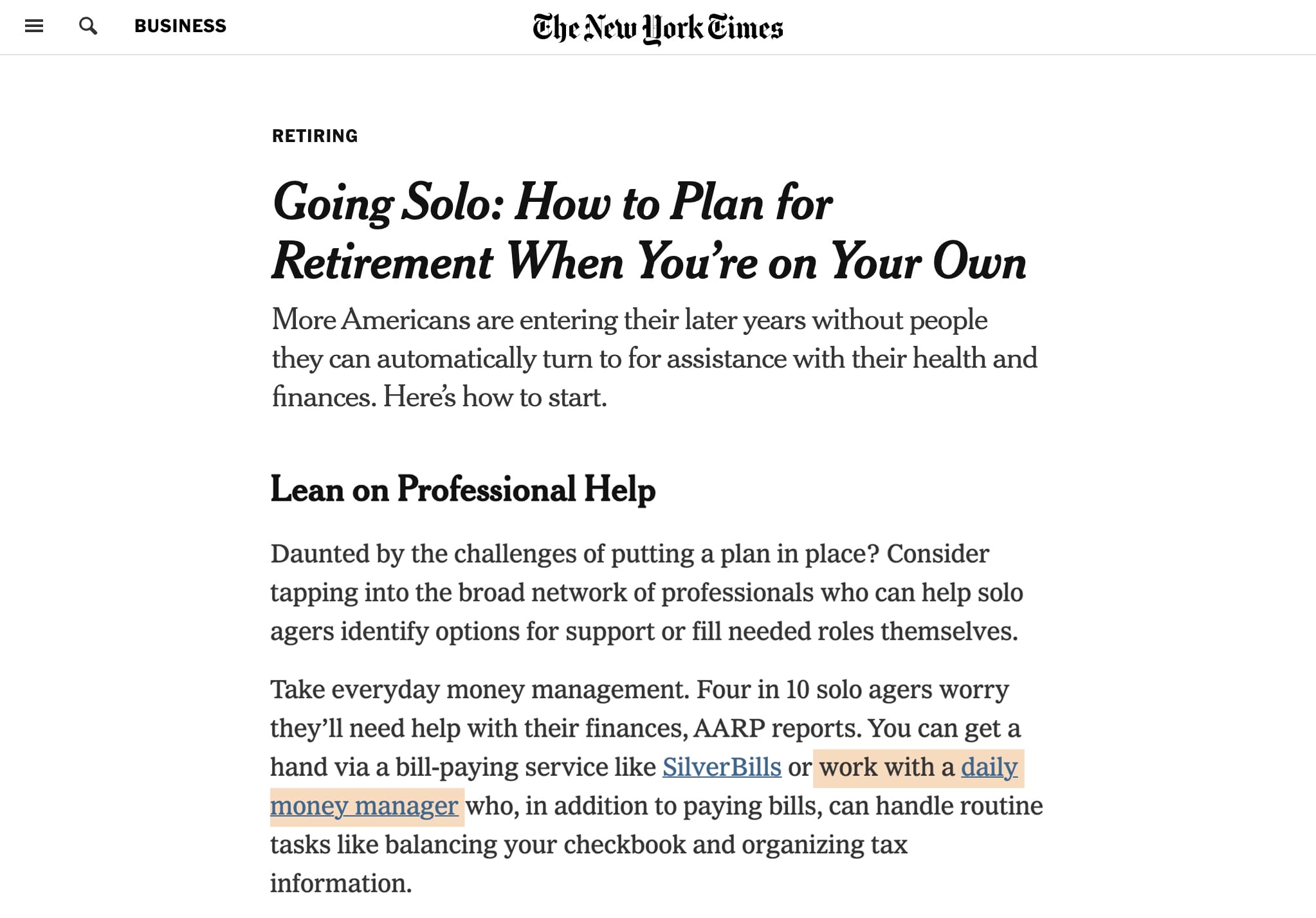

In a timely AP News article, the columnist Liz Weston CFP® of personal finance website NerdWallet shared tips on how to talk with your parents about “important money issues, such as estate planning or long-term care” this holiday season. Working with a daily money manager is one of the practical suggestions offered.

Weston talked with Amy Goyer, AARP’s national family and caregiving expert, about three specific steps to take to prepare for a productive conversation that doesn’t ruin a holiday gathering.

Step one is to adjust your attitude. “Even though your role changes, you are still their child, and therefore they deserve your respect,” Goyer says. The article continues with specific (and common) examples you might encounter.

“Instead, research some options in advance so you can present choices to your parents rather than issuing orders. If they don’t have long-term care insurance, for example, they might be able to sell investments or tap their home equity to pay for a nursing home stay. If they don’t have an advanced directive or other estate planning documents, you could offer to help them use estate planning software or find them an estate planning attorney. If bills aren’t being paid, you can offer to set up autopayments, take over bill paying or find a daily money manager who will do it for a fee.”

To read the complete article, visit: Liz Weston: How to talk money with your parents this holiday, AP News