Remember when credit cards were for travel, not grocery shopping? Recall the days before debit cards?

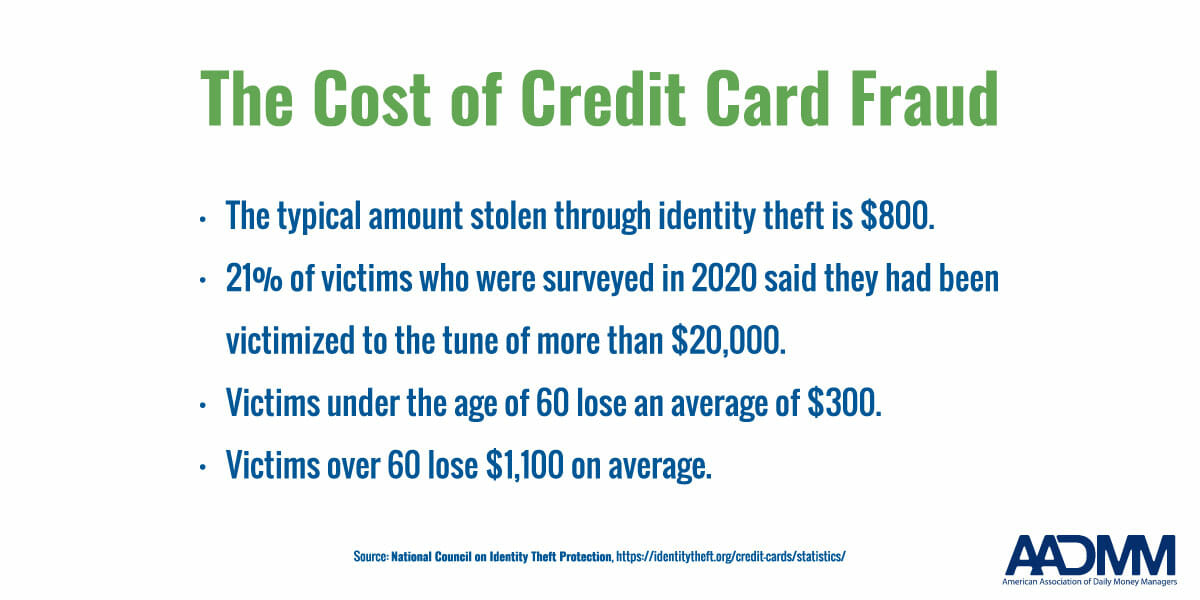

We are all using plastic more than ever—for both large and small purchases. And so are scammers and fraudsters! About 31.8 million U.S. consumers had their credit cards breached in 2014. By last year, the number of U.S. data breaches tracked reached an all-time high. (Not all breaches are reported to victims or make the news. To keep up on the latest, go to www.privacyrights.org)

All of this means we have to look more closely at our credit card and bank statements – and then act promptly when something seems amiss.

Five Ways Daily Money Managers Can Help

Here are five easy and painless ways daily money managers help clients manage their credit and debit card accounts:

- Simplify. Older adults who use credit cards carry an average of four. That means four statements, four due dates, four minimum payments, four rewards programs to master, and four opportunities to misplace a card. Unburden yourself and your wallet by paring down the number of credit cards to two or three at the most. How to choose? Compare your cards based on the number of years you have had them, credit limits, interest rates, and any other factor important to you (like rewards). Just the process of evaluating your cards can be an education in itself. If you want to hold on to additional cards, put them in a safe place at home. (And don’t forget about cards you opened years ago and never use or can’t even find anymore. A free credit report (www.annualcreditreport.com) will let you know what’s out there in your name.)

- Scrutinize your monthly statements. If you opt to go paperless, it’s easy to ignore notifications from the bank that your statement is available. Remember that it’s up to you to recognize unusual charges.

- Copy and chart your cards. Make a copy of your cards–front and back. Also create a chart showing the account number, customer service number, when in the month the bill arrives, the typical balance, and how it’s paid (if direct debit—from which account?) Make a similar chart showing direct debits from bank accounts. In the event of fraud or your illness, these documents are valuable reference tools for you, your power of attorney, and your family.

- Match credit card slips to your statements—to detect irregularities and track spending. See what works best for you for collecting receipts before the monthly statements arrive: A zip bag in your purse to hold receipts as you get them? Labeled envelopes in a desk drawer for each of your credit card accounts? Copies by email? Remember to print receipts from online shopping, too. Check your statements’ accuracy by matching receipts to the statements. (You don’t need to keep most receipts past that point, except those for major purchases, items you might return, or receipts for tax-deductible items.) Tracking how you are spending your money takes some effort. Digital tools can help or even an old-fashion spreadsheet—if you’re willing to record and categorize charges.

- To protect yourself, the U.S. Postal Service also suggests:

- Don’t leave your credit card unattended

- Request credit reports annually

- Keep financial information secure

- Shred important documents

Tips for How to Find Help if You Suspect Fraud

Act quickly but don’t panic. Federal laws provide protection for credit card and, to a lesser extent, debit card holders. In the case of unauthorized use of your credit card, the Truth in Lending Act limits personal liability to $50 without a time limit to report a card lost or stolen. With debit cards, report a lost or stolen card within two business days to limit personal liability for fraudulent charges up to $50.

Report financial fraud as you would any other crime. (Only one in five of these crimes is currently reported.) Third parties may be able to help get your money back or remove fraudulent charges. If you used your credit card or bank account to pay a scammer, report it to the card issuer or bank. Also, report scams to the major credit reporting agencies. Place a fraud alert on your credit report to prevent someone from opening credit accounts in your name.

Fraud can also be reported to the US Senate Special Committee on Aging’s Fraud Hotline 1-855-303-9470 and the Consumer Financial Protection Bureau 1-855-411-CFPB (2372).

The Federal Trade Commission’s IdentityTheft.gov offers resources and a checklist to help you report and recover from identity theft.

Karen R. Caccavo is a Daily Money Manager and owner of Personal Money Manager™ in New City, NY.