For some reason, there’s a common misconception that budgeting and daily money management are only for people living paycheck-to-paycheck or young people just starting out. The truth is, you’re never too wealthy to budget. When we get financially comfortable and let daily money management fall lower and lower on our to-do list, we end up setting our money on autopilot. And that’s when unintentional spending happens. What you might think is only a few bucks here and there, really adds up.

Right-size your accounts

It’s easy to forget not all account plans are one-size-fits-all. Businesses make money when someone pays for more than they use. But why pay more for using less? A few places we see this happen:

- Phone plans – What’s your average monthly usage? (Open your statement or log into your online account to find out. Calculate average usage over six months for a good data point.) Does that average drop you to a lower tier plan as opposed to your current plan and/or an unlimited plan?

- Credit Cards – You opened the account because of the reward benefits. But do those rewards (and their associated annual fees) really benefit you? For example, paying fees for a travel rewards card but you don’t travel. If you carry a balance on one of these rewards cards, the higher interest rate often makes it more expensive than the reward you are chasing.

- Club Dues – Swim club. Tennis club. Yacht club. You signed up the whole family and pay the yearly fee for a family. Yet only one or two family members go to the club regularly. This adds up to hundreds, if not thousands, every year.

Cancel recurring charges on inactive accounts

- Subscriptions, memberships, etc. can really add up. Maybe you used to read Travel + Leisure or Architectural Digest every month. But it’s been ages since you sat down and read one of your (many) magazines cover-to-cover. Yet you just haven’t made the time to call or go online to submit a cancellation request.

- Digital entertainment services like Netflix, Hulu, and Amazon Video revolutionized how America watches TV. Yet you’re too busy to sit down and enjoy the service you pay for. You tell yourself, “Oh, it’s only $8, $10, $15 a month. Not a big deal.” There are also homes with top-tier cable or satellite bundles AND subscriptions to streaming services. They could save hundreds (!) a year by cancelling the extra services.

- Then there’s that app (or, more likely, multiple apps) you just had to have at that moment. You enjoyed them for a few months and now they lay dormant on your phone or tablet – taking up not only space on your phone but space in your bank account as well. Just because you delete the app does not mean the fees stop.

Again, it’s about intentional spending versus money on autopilot. All these little charges add up to effects on your budget, financial goals, and overall financial health. No one we have met likes paying more and regaining the satisfaction of paying only for what you use feels gratifying. Remember, you’re never too wealthy to budget.

Do any of the above situations hit home? Then take back control of your money and spend because you want to, not because it’s set on autopay. We recommend you open your mail daily, pay your bills on time, and review transactions in your accounts regularly to help protect yourself against fraud.

Solutions for Your ‘Too Wealthy to Track Money’ Mindset

Lets look at ways to transform a “too wealthy to track money” mindset into a workable solution for you and your finances. After all, we wouldn’t want you to tank your credit or make tax time a nightmare – both of which can cost you time, money, and well-being.

So, you basically have two options to bypass the “too wealthy to track money” mindset.

Option 1: DIY

Maybe you’ve never had a money management system: you just paid bills as they showed up and left account management to the banks, CPA, financial advisor, creditors, etc. – relying on them to let you know if you missed a payment or alert you to potential fraud.

Or maybe you had a solid money management system in place, but you no longer use it for whatever reason.

A plan or system is key to successful daily money management especially if you’re doing it yourself.

- Streamline – Be proactive, not reactive. Including the below suggestions for mail and bills, declutter your daily money management with these 5 Ways to Streamline Finances.

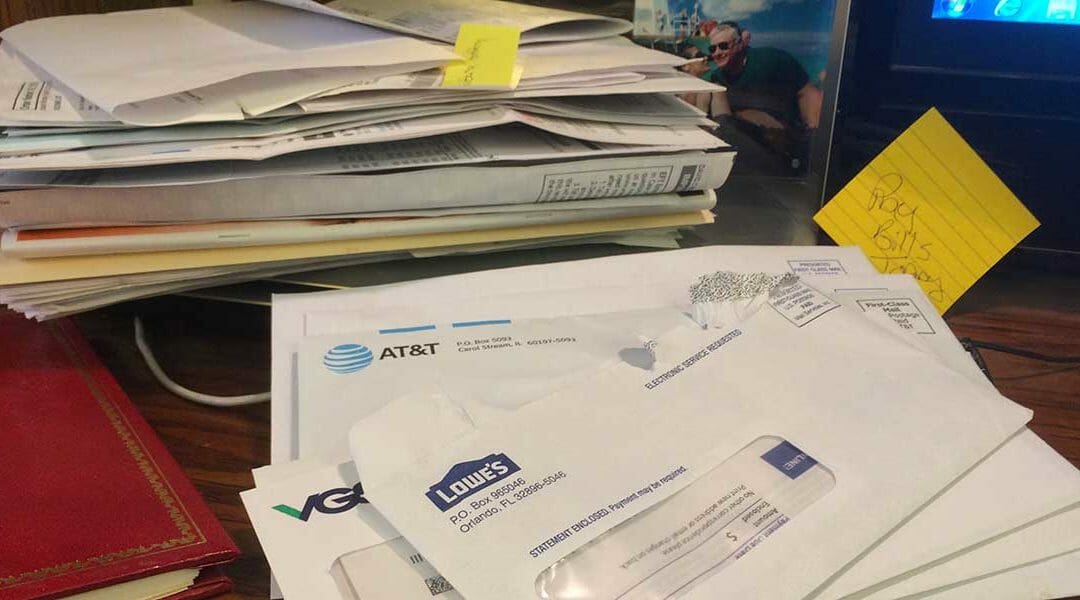

- Mail – It probably goes without saying: we all dread junk mail. It’s probably the biggest reason we grab the mail, walk to our favorite catch-all spot, and drop it like a hot potato. Not taking the time to sort important mail from the junk mail can turn an unpleasant process into a bigger headache. How? Because along with the junk mail, you’re also ignoring bills, important account notices, maybe even fraud alerts.

- Bills – Here’s where your credit score could be at risk. Whether you lost a bill (amidst the junk mail) or simply forgot about it, late payments will impact your credit rating and by extension your overall financial health. Enroll in electronic statements to eliminate the paper clutter and read through your statement when you receive email notification that it’s ready. Also, set up your monthly payment to auto-pay itself.

Chances are high, if you’ve stopped working the system it’s either because it isn’t a good fit for you, you simply don’t enjoy it, or the system is overly complex.

While there are ways to transform a “too wealthy to track money” mindset, the easiest (and likely the best) solution would be to hire someone else to do this for you.

Option 2: DMM

So, you used to have the time and energy for daily money management — on top of all your other responsibilities like managing your household, career, social calendar, etc. But now, you’re simply too busy. And if you’re being honest, you just plain hate balancing your checkbook, following up to make sure that service or app you cancelled has in fact been cancelled, or reviewing account statements for accuracy.

Enter: the daily money manager (aka DMM). Benefits include:

- Eliminate tasks from your to-do list. Someone else will do the financial tasks you either don’t have time for or don’t enjoy doing.

- Decrease the financial clutter and, by extension, eliminate late payments and reduce the risks of identity theft.

- Relax, knowing exactly where your finances stand. No more guess work. No more last-minute chaos at tax time.

Our clients are always pleasantly surprised at the simplicity of our process. And the relief they gain, knowing they’re in control of their finances, is priceless. Not to mention the freedom to enjoy the lifestyle they’ve worked so hard to obtain. Let a professional daily money manager help you take control of your financial health.

#FinancialLiteracy

Nanette Duffey is a Certified Daily Money Manager™ (CDMM®) in Atlanta, Georgia. Nanette leads the Organized Instincts team. Articles first appeared on https://organizedinstincts.com/