Addressing Personal, Legal, and Financial Concerns

The American Association of Retired Persons (AARP) projects that by 2030, approximately 16% of women will be between 80 and 84 years old and childless (Donald Redfoot, Lynn Feinberg, and Ari Houser, “The Aging of the Baby Boom and the Growing Care Gap: A Look at Future Declines in the Availability of Family Caregivers,” Insight on the Issues, AARP Public Policy Institute, August 2013. What are elderly persons who are without children or other family to serve as caregivers supposed to do? This article outlines some practical issues to consider, along with legal and financial matters for those who are fortunate enough to reach their 80s and beyond.

Who Will Manage the Senior’s Finances?

As with personal care, people may become unable to manage their own finances as they age. Depending on the degree to which assistance is needed, there are several options.

Daily money management programs.

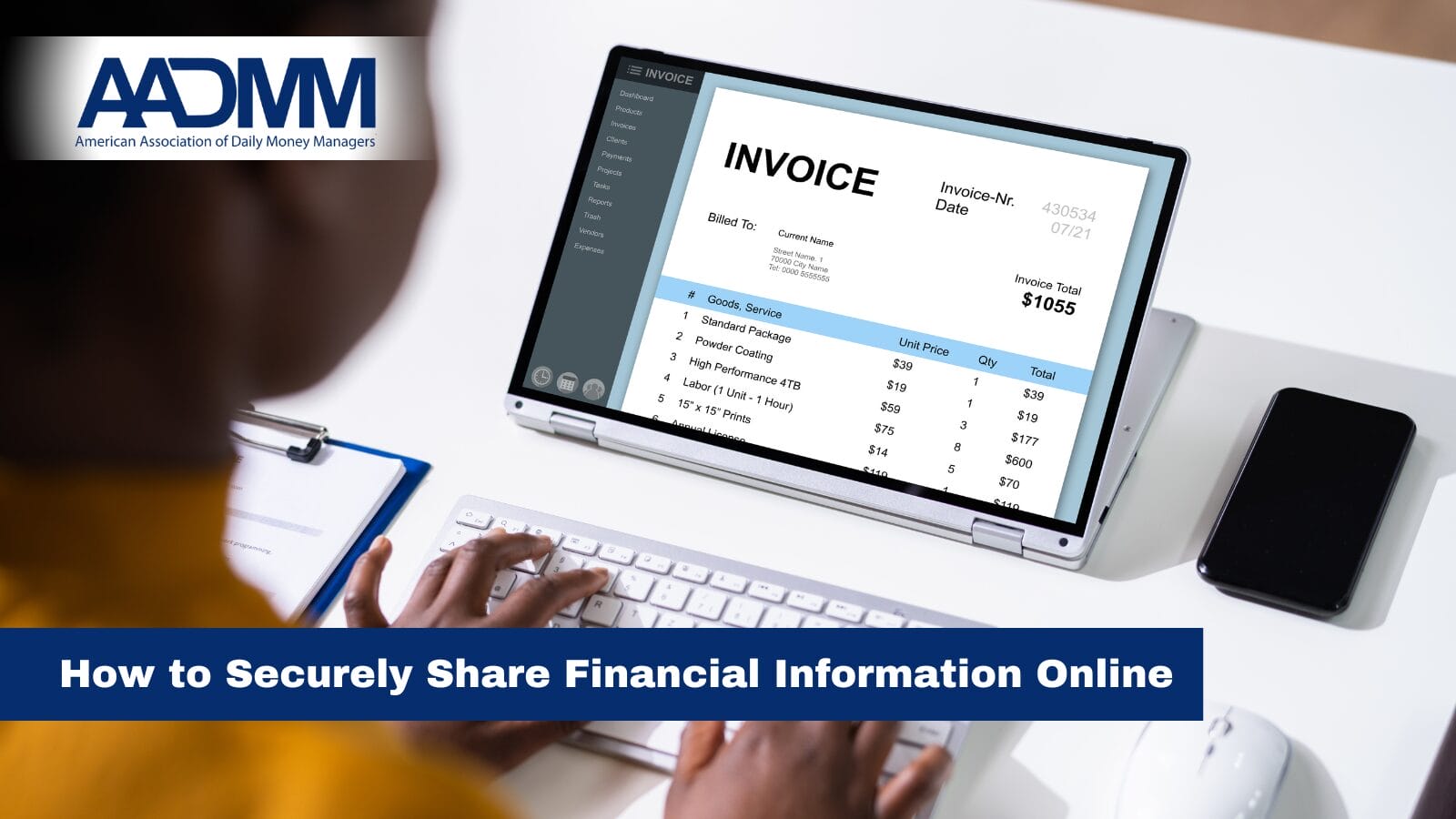

There are companies that can handle bill paying and other routine financial matters for elderly individuals; they may also be able to deal with health care insurance forms. Professionals offering these programs can be found through the American Association of Daily Money Managers

Read the article: Getting Older Without Family at The CPA Journal.