Keeping track of your money can often feel like a separate career. It is easy to go from dedicating a few hours a month paying bills as you start your career to a much longer process as your assets and family grow. A Daily Money Manager (DMM) can help. DMMs are trusted professionals who pay bills, reconcile accounts, keep track of investments, organize tax documents, review and renew insurance coverage and other financial tasks – basically anything attached to a dollar sign. How do you know if you could benefit from a DMM? If any of these situations apply to you, it could be time to hire a DMM.

- YOU ARE A BUSY PROFESSIONAL

Several of our clients have busy careers, multiple investments, and sometimes homes in multiple states. Meanwhile, they are also raising families. With so many important things to juggle, many just don’t have time to look at the day-to-day financial details.

A DMM will make sure the lights stay on at all the properties, property taxes are paid on time and pertinent receipts are kept for tax preparation. They will ensure credit card statements are reviewed and paid on time. A DMM also oversees that insurance policies are reviewed prior to renewal to ensure all assets are covered appropriately. With a dedicated manager, bills and important correspondence will not be overlooked. In some practices, clients have the option to review each bill before it is paid or choose which ones they’d like to see based on markers like payee or dollar amount thresholds. Some DMM practices are totally paperless, so the processes can be completed anywhere with an internet connection.

A DMM will streamline your financial processes so you’re spending less time looking at details and more time enjoying what you have built.

- YOU WANT YOUR FAMILY TO RUN LIKE A BUSINESS

Just as your business has a month end close and financial reporting to help you make better decisions, your family can benefit from similar attention.

One of our clients is a serial entrepreneur. He also has children and wants them to learn about financial fitness and responsibility. Alongside his business reporting, he has asked us to create a family Profit and Loss report for them to review monthly – children’s accounts included. With this reporting, he can show his family actual data about income and expenses which teach financial literacy. Then, they can create realistic budgets so they all can reach their goals.

We also create a personal financial statement for this family, consisting of a personal balance sheet with assets and liabilities. In addition, we keep track of the family’s investment portfolio, consolidating statements from different brokerages and reporting on them in one place.

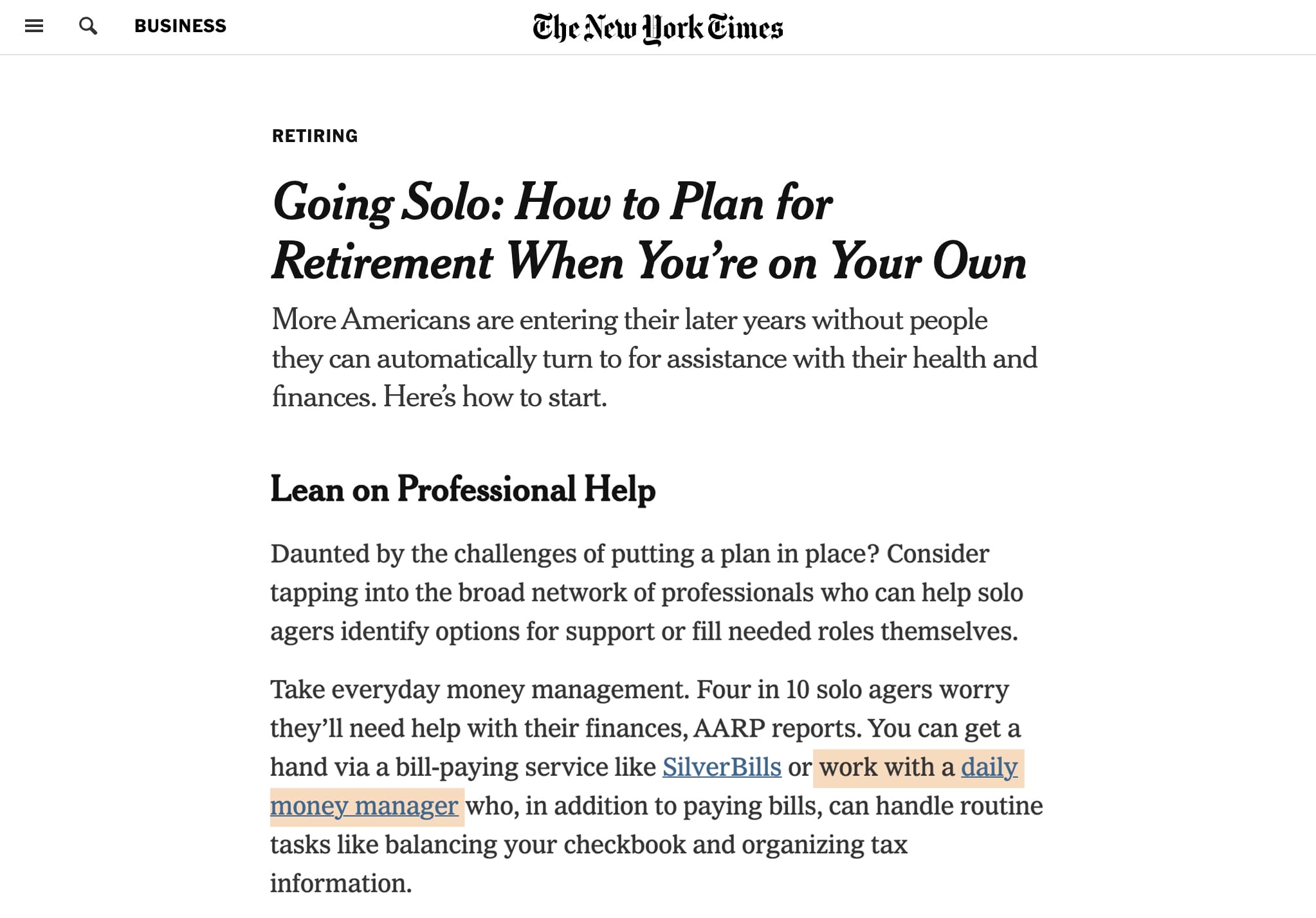

- YOU NEED A TRUSTED ADVISOR TO HELP NAVIGATE YOUR FINANCES

While you might contact your CPA a few times a year and your attorney when specific situations arise, you will be in touch with your DMM more often. We are in ongoing communication with our clients, paying bills weekly and reconciling accounts monthly at a minimum. We are in place to notice when a transaction will have a tax consequence and will notify the client and their CPA that a discussion is necessary to limit tax impact.

We also update fair market value of real estate and vehicles and watch for purchases of high value items such as art and jewelry, to make sure the client adds them to their insurance policy.

We’re a second set of eyes, reminding the family to make sure preparations are made for college savings, retirement, and estate planning. We’re standing with the client at the center of a hub of trusted advisors, helping coordinate needed items for their accountant, attorney, financial advisorr, banker, and insurance provider. We’re often the go-to person the client relies on for copies of important documents that we keep in our secure permanent files.

To obtain professional certification, Certified Daily Money Managers (CDMM)have passed an exam, satisfied continuing education credits, have passed background checks every two years, and follow a Code of Ethics.

———-

Jacqueline Weiss has been an accounting professional for over 25 years and a Certified DMM through AADMM since 2018. She is a senior manager in LBMC’s Family Office practice, which offers a team of DMM professionals.