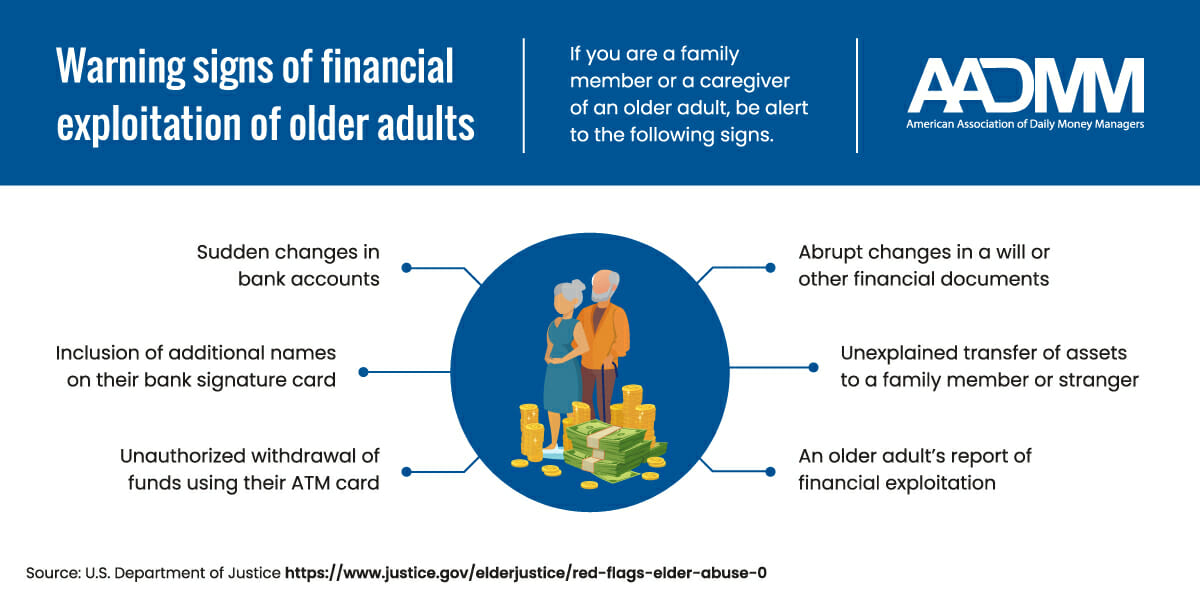

Financial scams and fraud are more prevalent than ever and fraud can happen to anyone. While technology has brought some of this on, it also provides new methods to protect yourself, loved ones, or clients from scammers. Let’s look at an assortment of popular fintech tools.

What is Fintech?

“Fintech, or financial technology, is the term used to describe any technology that delivers financial services through software, such as online banking, mobile payment apps or even cryptocurrency. Fintech is a broad category that encompasses many different technologies, but the primary objectives are to change the way people and businesses approach their finances and compete with traditional financial services.” (US Chamber of Commerce – https://www.uschamber.com/co/run/business-financing/what-is-fintech)

Popular Fintech Tools

AARP is an incredibly rich source of material on all things for people over 50. The Scams & Fraud section offers Scam Alerts, Fraud Fighting, and Victim Support. Technology Tools to Help Guard Against Elder Financial Abuse is an excellent article that mentions some Fintech programs that we use. Below I’ll discuss two companies referenced by AARP and a strategy we use to protect our firm’s clients from scammers and give specific real-world examples.

Prepaid Visa Debit Card

True Link Financial supplies a prepaid Visa debit card at the cost of $10 a month. The cardholder or administrator can limit where the card is used, how much can be spent, and if cash can be taken from an ATM or received as “cash back” when paying with the card at a register.

The True Link card can be replenished at regular intervals if it goes below a certain level, or just a one-off. The degree of control that the administrator has is vast.

The True Link card is also a safe way for a caregiver to access their client’s money. Giving someone a credit card allows them to charge up to the credit limit. Handing someone a bank debit card gives them access to all the money in the bank account. We find that the True Link card is a great way to minimize this risk because of the range of controls it provides.

Unfortunately, a client of ours has lost his short-term memory. Prior to working with us he was buying extended auto warranties, bought gift cards to give to scammers, and purchased odd items online. Simply taking his credit card away was not a solution because he did need it for items for the home, groceries and to order dinner. The True Link Financial card was the answer.

Using the “Spending Monitor” in the Dashboard section of the website we were able to limit the use of the card. The first thing we did was block “Online and phone purchases”. However, we were able to make an exception for restaurant deliveries. This was crucial since our client often orders Chinese food for dinner.

A great feature allows administrators to receive real-time alerts to track purchases and withdrawal attempts. A bonus is that you also see when something is denied. For our client, this is not an issue because he gets the thrill of making a purchase but doesn’t remember that it was made. We always contact his family when we get these messages so they can check in, just in case.

You can choose Merchant Settings to limit the actual stores the user is allowed to purchase from. For our client, we allowed a couple of local groceries but blocked everything else. In addition, we controlled the Spending Categories, allowing laundry, medical, and travel but not charitable donations, hotels, or pawn shops, among others.

True Link has allowed our client to safely make purchases, giving him a feeling of independence and providing peace of mind to his family.

EVERSAFE

“EverSafe® guards against fraud, identity theft, and age-related issues.” They do this with a four-step process.

- ANALYZE: Examine historical financial behavior to establish a personal profile. Transactions are analyzed daily to identify erratic activity.

- IDENTIFY: Look for anomalies like unusual withdrawals, missing deposits, irregular investment activity, changes in spending patterns, late bill payments, and more.

- ALERT: Suspicious activity alerts are delivered by email, text, phone, or the EverSafe App. And EverSafe’s “trusted advocate” feature enables members to designate family, professionals or other trusted individuals to receive alerts and assist in monitoring.

- RESOLVE: EverSafe provides tools to manage the resolution process and helps its clients create their own recovery plan.

EverSafe is a very comprehensive program. It provides a great deal of information, and the customer service is excellent. A key component of the service is the monitoring of Credit-Bureau reporting. Common messages are: Tri-Bureau Monitoring Alert, Account Balance has been increasing, and Activity on Dormant Account.

The Tri-Bureau Monitoring Alerts are extremely helpful as they will appear when a request is made for a credit increase, or a new account or loan. A client of ours uses EverSafe to monitor her credit cards and many bank accounts. A few years ago we noticed a Tri-Bureau Monitoring Alert; we knew that our client did not want any new credit cards, certainly didn’t need to increase her line of credit and wasn’t in the market for a loan. We contacted each credit bureau to pre-empt the creation of any fraudulent accounts.

Budgeting Strategy Tools: The backbone of our daily money management business is the monthly downloading of our clients’ checking and credit card accounts into a Fintech budgeting tool. We happen to use Quicken but there are many programs out there that allow you to import financial transactions and categorize them.

This can be a lot of work in the beginning, especially if you are importing many months of data. Time needs to be spent with a client to find out what all the transactions are for. Certain ones, like utilities, are easy to figure out. But some stores or websites might require more work. We put any transactions we don’t know into “Uncategorized” and review them with the client.

Over time we get to know our clients’ spending habits and the uncategorized items require less time to review together. They also help in locating possible fraud. Here are two successful examples of using this old-school Fintech to prevent scammers.

A couple of months ago we were reconciling a client’s American Express account and noticed three transactions for roughly $500 each being sent to someone in Chicago. We didn’t think our client had a Venmo account and thought it was weird that it was through American Express. We contacted AmEx with the client and were told to contact Venmo. We did that immediately and Venmo reversed the transactions. American Express canceled the card and sent a new one the next day.

The other case was more traditional. Many of our elderly clients still like to write checks. While we try to do as much as possible electronically, we also understand the need for people to retain the feeling of control over their finances. For these clients, we download the check images from the online bank accounts and review them individually. A few years back we had a spate of checks being written for a family member’s tuition, college room and board, and other expenses. On top of that, the signatures did not match that of our client. While very disturbing we caught this early and brought it to the attention of our client and his bank. Happily, restitution was made.

There’s no doubt that financial scams and fraud are more prevalent than ever. We suggest exploring different methods of preventing scammers. The key is to be vigilant, use several techniques, and stay informed.

Peter Gordon is a Daily Money Manager, Certified Senior Advisor, and President of New York Financial Organizers, Inc. in New York City.