Recently I was asked to serve as a guest expert by a wealth management firm with offices in Vermont, upstate New York, and Florida. This group of investment advisors and CERTIFIED FINANCIAL PLANNERS™ hosts a monthly online video Lakeside Chat for community members and clients. Always happy to spread the word about how daily money managers can help older adults, high-net-worth families, and other professionals, I agreed. The experience highlighted for me the benefits of building a personal financial team of two or more professionals.

The Top-Line Benefits of Having a Daily Money Manager-Investment Advisor-CFP® Team

- As an individual client or family, you are better and more efficiently served

- The CFP® professional or investment advisor has the information they need to help you assess your risk tolerance and meet your long-term goals

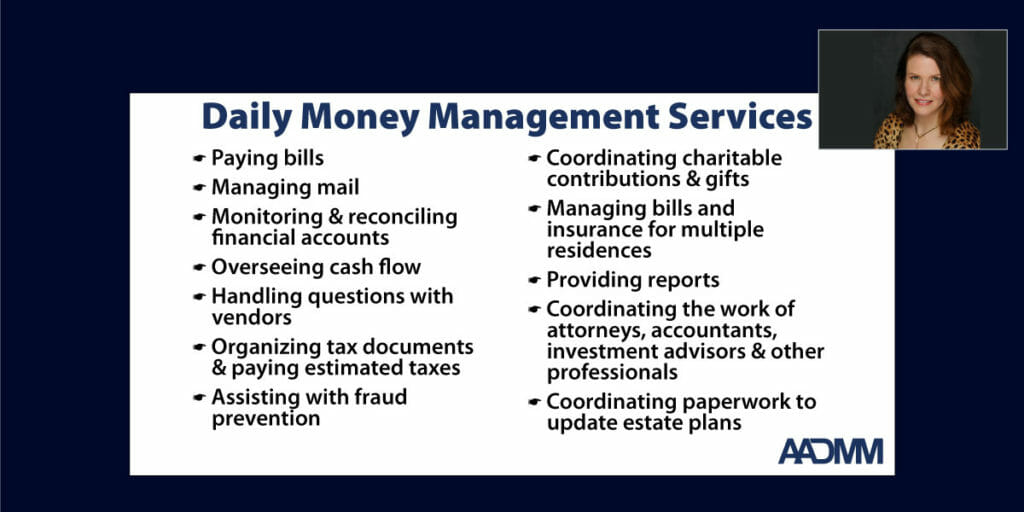

- The daily money manager can handle your everyday finances, track income and expenses, be alert for fraud, and orchestrate details for your team

Relief from Time Pressures and Distractions

Completing the initial financial inventory for a financial planner or compiling your records for an annual tax return can feel like an overwhelming task for busy professionals or small business owners. This may be especially true if you have experienced a significant life event in your family or you are worried about early signs of cognitive impairment for a loved one. At best, it’s simply not how many people want to spend their time. I think I heard audible sighs of yearning as I reviewed a list of daily money management services during the Lakeside Chat.

Necessary Financial Information is Available

As a financial planner or investment advisor, it’s impossible to help you get where you want to go unless you know where you are now. Unfortunately, getting this essential information is often a major barrier to developing a personal financial plan or updating your program after a life event change such as a new baby, marriage, death, divorce, or inheritance. Your daily money manager can give you the necessary records or, with your permission, share that information with your financial planner so they can meet your needs faster and more effectively.

Conflicts of Interest Avoided

Laws, regulations, or a professional code of ethics designed to protect you may restrict the services your investment advisor or CFP® professional can provide to you as a fiduciary required to act in your best interest. For example, in 2021, the Financial Industry Regulatory Authority, or FINRA, one of the regulatory bodies for financial advisors, finalized Rule 3241, which limits registered advisors’ ability to act as your trustee, power of attorney, or executor. However, many daily money managers serve in such roles — another benefit of having a personal financial team.

Daily Money Managers Work Well with Other Professionals

Depending on your unique circumstances or life stage, you may need an expanded team of financial professionals, for instance, a tax preparer, CPA, estate lawyer, insurance agent, Certified Senior Advisor, or Aging Life Care professional.

An Invitation to Find a Situation Similar to Your Needs

My recent invitation focused on collaborating with financial planners. Still, I invite you to explore the Money Matters resources I have gathered below, which include examples of situations and scenarios where daily money managers work as part of an expanded team to serve individual clients.

RESOURCES

- Resources to learn more about how other professionals serving older adults or those with disabilities, including cognitive impairment, collaborate with daily money managers:

- The Surprising Story of One Older Couple, Their Living Options, and Two Professionals [CSAs]

- Care Collaboration: How Professional Teamwork Can Serve Your Family During Stressful Times [Aging Life Care professionals]

- Daily Money Managers: Agents Under a Power of Attorney, Trustee, or Executor [Estate attorneys, financial planners, banks]

- How a Daily Money Manager helps with Your Tax Return Preparation [Accountants, tax preparers]

- Resources to learn more about how other professionals serving high-net-worth individuals and small business owners collaborate with daily money managers:

- When Your Personal Life Needs to Run Like a Business

- What is the difference between a bookkeeper and a daily money manager?

- Financially Comfortable? How to save time on daily money management

- Resource on how to find credentialed professionals for your financial team:

- Lakeside Chat Video, In Case You Missed It

Robyn Young is a Certified Daily Money Manager (CDMM®) and owner of Money Care, LLC in Williston, Vermont, specializing in busy professionals and high-net-worth families and individuals.