“Hello Heather, this is Dave Stieglitz with Oasis. I have an unusual case and was wondering if you could call me back.”

The Two Professionals

Heather Jackson is a Certified Daily Money Manager® (DMM) with Jackson Personal Financial Services and Dave Stieglitz is a Certified Senior Advisor® to seniors and this is a case about how we worked together in conjunction with additional professionals to find solutions for a senior couple needing immediate attention.

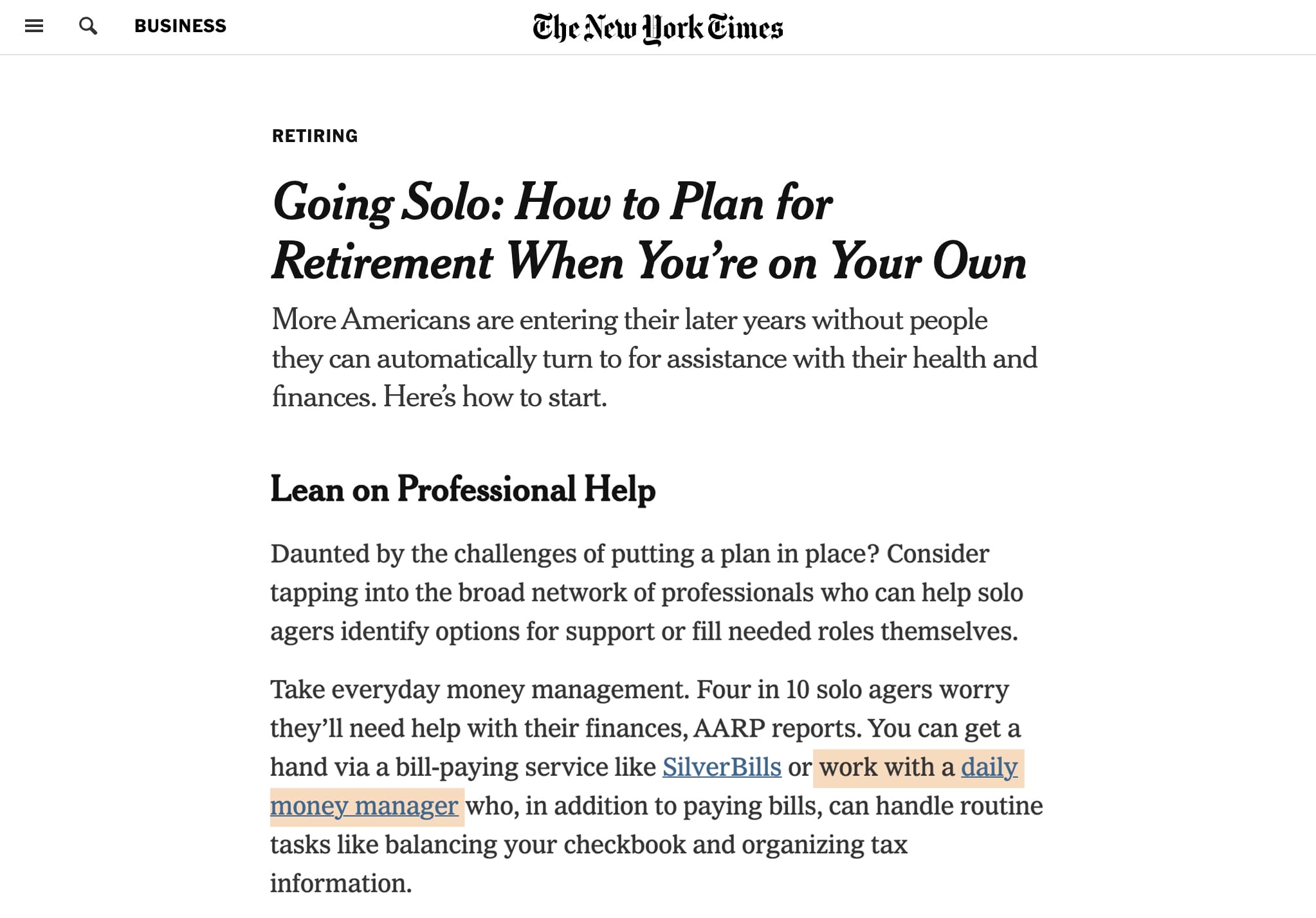

A daily money manager is a professional specializing in providing personal financial services to older adults, people with disabilities, busy professionals, high net worth individuals, and the owners of small businesses. Part of the role as a DMM is to have trusted and experienced resources to work alongside for the best interest of the client. Another role is to have expertise in understanding a client’s income and expenses.

Dave Stieglitz is a Certified Senior Advisor® with Oasis. He has expertise in the local senior home communities and neighborhoods, such as independent senior communities and assisted living communities. He works with a wide range of incomes and is a true professional in working with clients. To do his job, Dave must understand how much a client has to work with regarding income and assets in choosing a community. And the best part is that his services are paid by the community – not the client.

Messages like this are intriguing. “Unusual” typically means difficult or troubling. I refer to Dave because he is patient and knowledgeable of the various options for retirement communities and the services available. There is often shell shock when families tour retirement communities because of the cost. Dave refers clients to me because he has identified that they need the support of a DMM.

The Older Couple

Dave called because there is a sweet couple living in their home, in their 90s, that have no children and very few relatives, and are in need of an assisted living community. They have a very modest home, and he is unsure about their assets. By the way, they are hoarders with decades of accumulated paperwork and treasures in their home.

The questions are many, but the immediate concerns are what they can afford and how to plan for an organized move.

Their Living Options

Dave needed a cash flow analysis to determine if the couple could afford an intimate small assisted living community with very nice amenities, or the polar opposite that no one really likes to talk about, or something in between. At first glance, one could make assumptions that would lead to the lowest cost and possibly lower quality.

The Surprise the Professionals Uncovered

My first appointment was an introduction and a conversation with the client. Discussion about checking accounts and saving accounts resulted in additional questions, and it was evident that the answers were in the paper piles throughout the home.

The first step, separating the piles – credit union statements, bank statements, investment statements, AND long-term care policies from the junk mail and catalogs. After opening and filing the statements, the picture is becoming clearer. A balance sheet provided the following:

- Annuities- 6 figures;

- Savings – 6 figures;

- and Savings Bonds – 5 figures.

Total assets over 7 figures, PLUS multiple long-term care policies which amount to ………5 figures A MONTH.

Dave’s clients are millionaires with solid cash flow. Happily, they can afford the first optimal option.

The Older Couple’s Story Continues

As part of the couple’s transition to their new assisted living home:

- The daily money manager worked with the client to hire a local family-owned business to clean, organize the treasures, and have an estate sale.

- The daily money manager provided choices for moving services to relocate their treasures to their new home.

- The daily money manager introduced them to real estate agents to sell their house as part of their transition.

- The client did not have a Will or Power of Attorney (POA) in place. At the clients’ direction, the daily money manager made introductions and they chose an attorney to work with putting their legal affairs in order.

- The daily money manager worked with the client’s existing accountant to prepare for the filing of their current tax returns. This process started when reviewing the piles and identifying the tax documents required for completing the return.

The client now has a team to meet all their needs, current and future. There were many working parts with the ultimate goal of giving this older couple the best quality of life possible so they can treasure the time they have available.

Heather Jackson is a Certified Daily Money Manager and the owner of Jackson Personal Financial Services in Jacksonville Beach, Florida. Connect with Heather on LinkedIn.