It’s not unusual to have prospects and clients alike assume that I am a bookkeeper. It’s easy for other professionals to put me in the bookkeeper “box” too. People have a place in their mental mind map for a bookkeeper, but they may never have heard of a daily money manager before. After working for many years as a private banker before starting my professional practice as a daily money manager, I can tell you there is definitely a difference between the two.

One Similarity, Many Differences

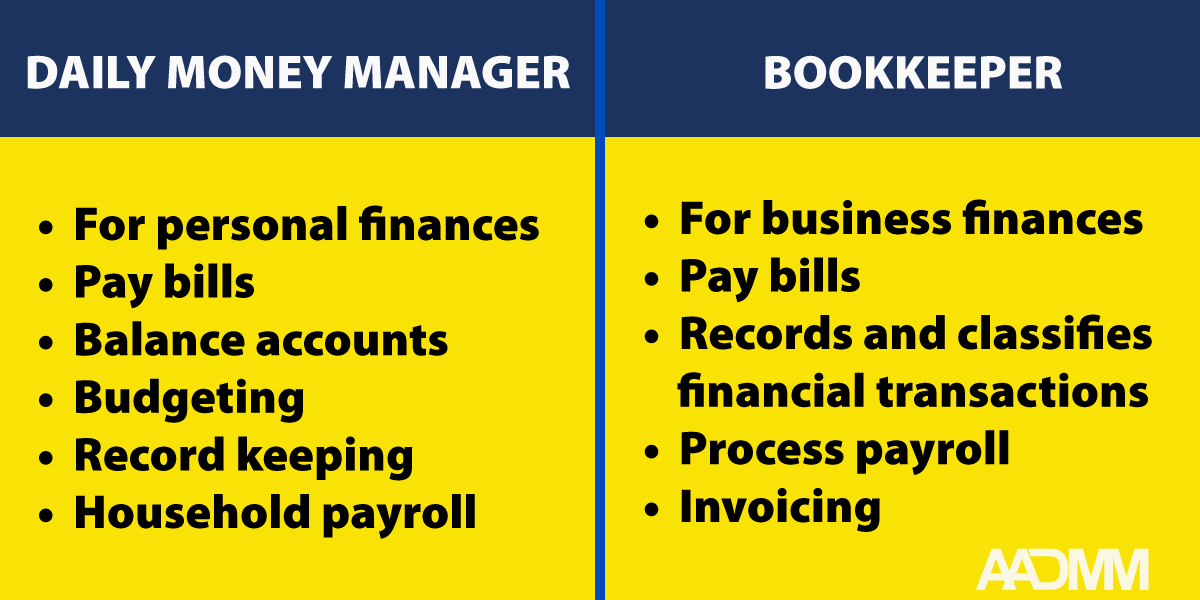

Both keep an eye on day-to-day finances, but daily money managers are distinctively different from bookkeepers because of who they serve, and they have different skill sets. During the relationship-building process with prospective clients and other professionals, I describe my daily money manager services and introduce them to the American Association of Daily Money Managers as a resource.

Bookkeepers

Bookkeepers provide a useful service to businesses. A bookkeeper handles the daily transactions and administrative work that feeds into financial reports such as a balance sheet, profit & loss statement, and cash flow statement. Bookkeepers may issue invoices, categorize expenses, and perform payroll duties. Bookkeepers are well-versed in managing software services such as QuickBooks, which produce those reports.

A Bookkeeper, or Bookkeeping Clerk, is a financial professional who is responsible for recording a company’s financial accounts and records. Their duties include checking accounting records for accuracy, tracking invoices and payments and maintaining a system for organizing company documents. — Source: Bureau of Labor Statistics, U.S. Department of Labor, Occupational Outlook Handbook, Bookkeeping, Accounting, and Auditing Clerks

Daily Money Managers

A daily money manager (DMM) is a financial professional who provides personal financial services to individuals and families, and who manages personal daily money matters such as bills, budgets, and record keeping and much more. DMMs can pay bills, balance checkbooks, research healthcare expenses, create budgets, and many other services. A daily money manager may specialize to provide personal financial services to older adults, people with disabilities, busy professionals, high net worth individuals, or the small businesses they may own.

Daily money managers are problem-solvers and collaborators with other professionals such as accountants, attorneys, financial advisors, social workers, and other professionals. As a daily money manager, we often do what others don’t want to do or have the time for.

Daily money managers are often contacted by the adult children of an older person because they see that their parent can no longer manage the tasks of paying bills and sorting mail.

Busy professionals feel that they don’t have time to take care of their banking. Many younger professionals are in need of financial education to plan for their future

Daily money managers can work with these younger people to understand their goals and educate them on what is available while collaborating with their CPA, attorney, financial planner, and other professionals.

The Best Choice for You

Is it possible to have both a bookkeeper and a daily money manager? Yes, it is, although frankly, it is not common. However, it depends upon whether or not a business is the primary need (bookkeeper) as well as the individual’s needs and how they communicate those priorities to the bookkeeper and daily money manager. In banking, we used to say that “every file has its own DNA”, and it’s so true that every client has different needs and priorities.

It’s important to sit down and ask what each professional does and how that fits into your needs so that you can determine the best option for your situation. Whichever professional you choose, be sure to ask questions about their previous experience, the scope of services provided, and if they have insurance and references.

For a more detailed list of questions to ask before hiring a daily money manager, please go to https://secure.aadmm.com/working-with-a-dmm/

Susan St. Angelo is the founder of My Trusted Partner LLC. in Indianapolis, Indiana.