In a world of few truisms, there is one that’s very consistent: the steady path to building wealth requires that you start saving from a young age. Developing financial literacy early fosters good financial habits around saving, spending, and other aspects of personal finance management that will likely promote financial stability across your entire life.

When it comes to saving, basic financial literacy is key to making informed financial decisions and starting to create wealth – or learning how to better protect it.

Evolution of the Typical Financial Life

Starting Out – High School, College, & First Jobs

Your income is typically low. Saving or investing may not be on your priorities list. You buy what you want with the money available, and you stop when the money runs out – unless you start hitting the credit cards.

What to focus on at this stage:

- Learn how credit works, and what debt really costs.

- Set up and manage a realistic personal budget.

- Start saving something now – the cumulative value of even small bits of saving matters.

Your late 20s and early 30s

With a steady income and more responsibilities (rent, utility payments, children), the variables that affect your financial well-being become more numerous and more complex. You start thinking about mandatory vs. discretionary spending, living within your means, planning for large purchases (buying a house), and servicing debt.

During this stage, the tools that help you stick to a budget become more important.

What to focus on at this stage:

- Scale your lifestyle to help meet goals.

- Learn how to save, how to borrow, and how to invest – how much, and where.

- Learn about basic financial tools, tax planning, and more.

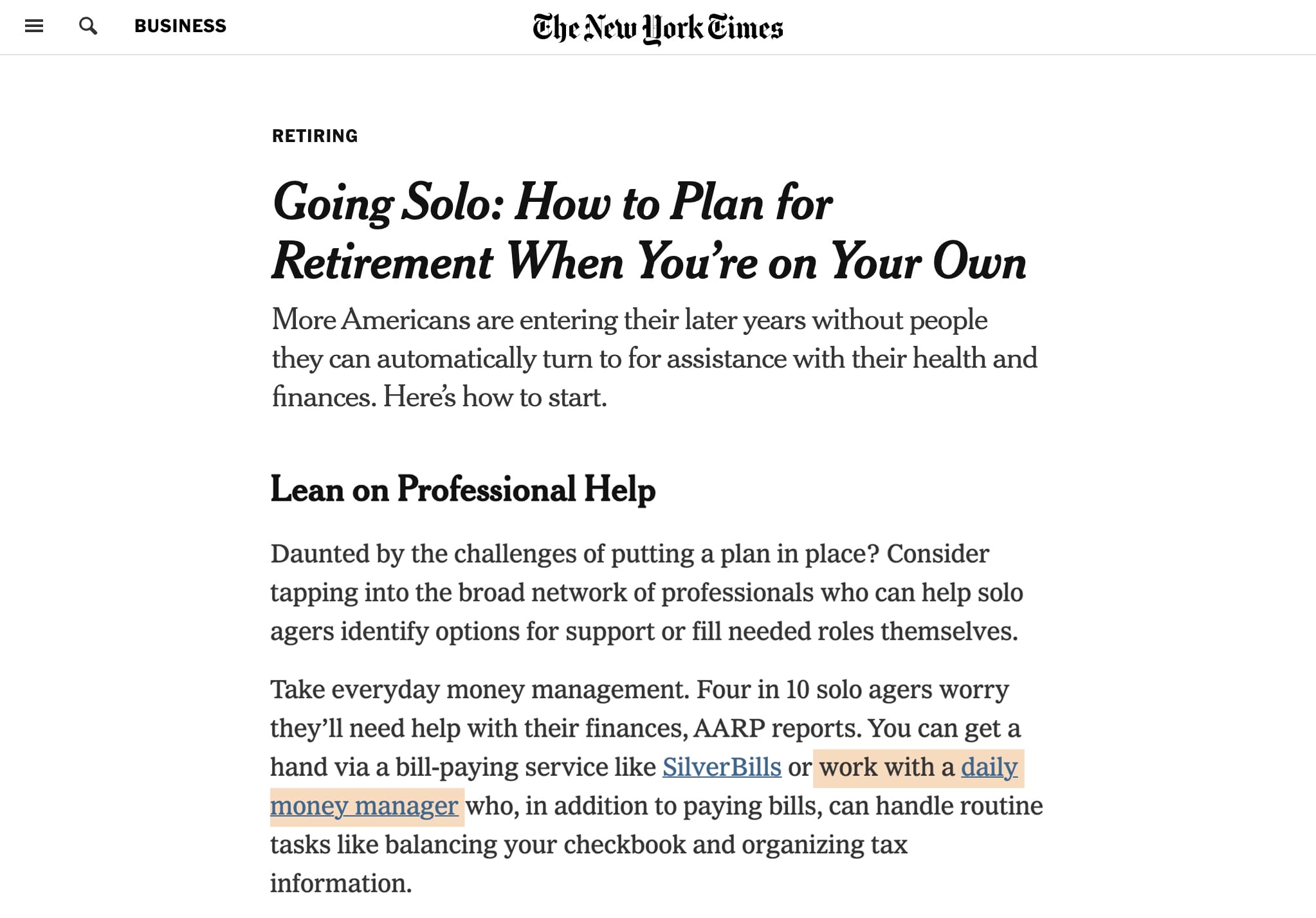

- Consult with an investment advisor, a CPA, an insurance agent, and/or other financial/legal professionals.

Your late 30s and early 40s

As you become more confident and capable of meeting mandatory expenses and you increase your financial flexibility, you develop a longer-term perspective. You prioritize saving for future needs (kids’ educations, housing options, retirement). You look to raise your credit rating by paying bills in full and on time. You manage credit more strategically to get better terms for car loans, mortgages, and other big expenses. And you pay attention to your investments.

What to focus on at this stage:

- Improve your credit rating.

- Determine your investment style (active or passive investor) and your tolerance for risk.

- Take advantage of company matching funds for retirement plans.

- Understand the insurance options that work with your planning.

- Learn the options for funding children’s educations.

Your 50s and 60s

These are typically the peak earning years, and financial literacy is critical in making the right moves. Now, you’re looking through the other end of the telescope, and time is not the asset it once was.

At this life stage, you will face the realities of the financial foundation you set when you first started out. You may need to adjust your finances to balance current obligations with building wealth to better secure your retirement.

What to focus on at this stage:

- Learn how to maximize your eventual Social Security benefits.

- Grow your retirement accounts through catch-up contributions.

- Explore tax planning that may involve converting traditional IRAs into Roth IRAs.

- Determine the applicability of long-term care insurance.

- Help your parents to secure their own finances so you don’t need to fund them.

While the world around us is anything but predictable, building your financial literacy at each stage of your financial life is valuable. It will provide you practical and proactive ways to manage change when it comes and mitigate both short-term and long-term risk.

Learn financial literacy basics as early as possible. Then apply that knowledge to grow your understanding as your financial life takes on more moving parts. You’ll have an edge for sustainable improvement of your personal finances.

We have seen the importance of a good personal finance plan in laying a solid foundation for the future. Let us know if we can help.

Rebecca Eddy, MBA, CDMM, is a co-founder and partner of Eddy & Schein Group in New York. Arlene Glotzer is the managing director of Eddy & Schein Group. A version of this blog post first appeared on the Eddy & Schein Group blog.