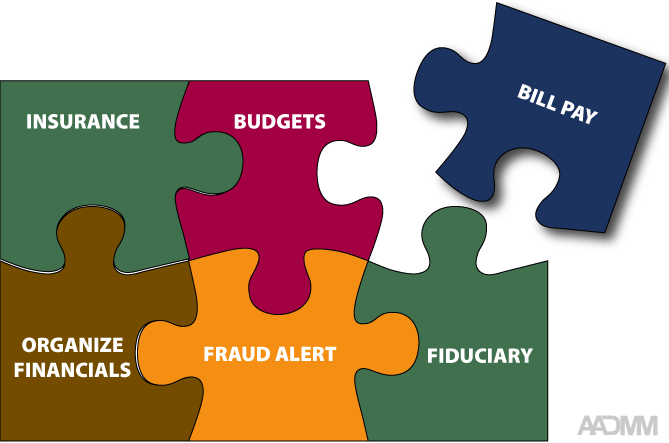

Daily money managers are much more than bill payers. True, the core of many daily money managers’ work often involves paying bills on time, reconciling accounts, organizing financial paperwork, and gathering tax documents. Yet many daily money managers (DMMs) provide services that extend well beyond these basic functions to meet the needs of their clients.

What are your needs?

The exact services daily money managers (DMMs) offer depends on the clients they serve. Some DMMs work primarily with older adults. Others focus on people going through life transitions such as the death of a spouse or divorce, those who are disabled, veterans, small businesses, millennials, busy professionals, or high-net worth individuals, to name a few. Often there is overlap. A busy professional may have a small business for which a DMM keeps the company books in addition to providing services to the owner. Consider a wide range of personal financial tasks for which a professional can help you or your loved ones.

Services for older adults

The Society of Certified Senior Advisors’ CSA Journal recently highlighted other services many DMMs provide, including:

- Preparing budgets and debt-reduction plans.

- Acting as power-of-attorney or representative payee for Social Security benefits.

- Providing fiduciary services such as power of attorney, guardian, conservator, trustee, or executor.

- Managing payroll for domestic employees such as nannies and caregivers, including verifying payroll taxes are paid.

As every individual is unique, the work of daily money managers is customized to their clients’ needs and situations. Some DMMs work with older adults and their families to analyze their client’s finances and identify appropriate living arrangements for the elders as they age.

When older adults are in cognitive decline, many want to maintain their independence and dignity, and remain in their homes. Many want to continue to pay their own bills. DMMs assist with this, by providing guidance and support while clients write and sign their checks and complete other paperwork.

Daily money managers support adult children who are acting as fiduciaries for their parents. In addition to assuming bill paying tasks, DMMs help navigate Social Security, Medicare, Medicaid, required minimum distributions, domestic employee requirements, and other financially related complexities in the lives of America’s elders.

Financial team liaison for clients of all ages

DMMs will support clients of all ages by working with the client’s professional advisors including attorneys, accountants, and investment managers. DMMs can attend meetings with the advisor and assist the client with doing the “homework” resulting from these meetings. For example,

- When clients have trust documents prepared, their assets need to be retitled to the name of their trusts. DMMs work with the client to identify, gather, and complete the necessary paperwork.

- When a person passes away and the surviving spouse is the executor of the estate, DMMs will work with both the attorney and the survivor to settle the estate.

- When an accountant needs a specific document, DMMs will work to locate it, helping the client request a copy when necessary.

Daily Money Managers can assist clients with completing loan applications and tracking down financial documents when needed for settling an estate or reaching a divorce settlement.

Financial fraud guard

Daily money managers are often on the front lines, acting as another set of eyes looking at clients’ finances. DMMs can identify when other individuals are stealing from accounts, making inappropriate online purchases, or committing other financial abuse. Although scams and fraud can occur at any age, financial exploitation of older adults is rampant.

Identify financial gaps

Daily Money Managers are also a set of eyes that will look at clients’ overall financial situations and help identify gaps. Are estate planning documents up to date? Does the client have sufficient or too much insurance? Is the client safe in his or her living environment? When a client needs advice or additional services, be it from a tax accountant, insurance agent, attorney, or an aging life care professional, https://www.aginglifecare.org, daily money managers will make appropriate referrals.

Building on a relationship of trust

The heart of daily money managers’ work is their relationships with their clients. Money is tied to many other aspects of individuals’ lives: their dreams, relations with family members, and the legacy they will leave. DMMs create relationships of trust and understanding with the people they serve. This not only gives clients a confidential outlet to voice their hopes and concerns, but also helps daily money managers provide customized services to meet their clients’ individual needs.

—————

By Robyn Young, CDMM, AADMM board member, and owner of Money Care, LLC in Williston, Vermont. Robyn blogs regularly on her Money Care blog.