When I start working with clients, I, like many daily money managers, always ask about estate documents. I want to look at the whole picture of my client’s financial health, and estate planning is a critical piece. Part of that estate planning is picking the right fiduciaries to act on your behalf. That person should be able to stand in your shoes if you are unable to act for yourself or to act on behalf of your estate to carry out your wishes after your death.

Don’t get stalled by indecision

I have had many clients over the years who were stuck in the decision-making phase and couldn’t choose their fiduciaries (Power of Attorney, Executor, Trustee, Health Care POA). They were trying to decide who would be the right person now and 20 or 30 years from now. When I am helping a client through this process, I always say it is unlikely that your fiduciaries today and 30 years from now are going to be the same people. Life happens, and circumstances change. They may not have a spouse or children to name now but might later in life, or they may have children with significantly different strengths and challenges who may or may not be able to take on those roles as they get older. The family dynamics may evolve so picking one child or sibling over the other or forcing them to work together would create a big family mess. Because the decision is not easy, clients may choose no one, leaving them without an estate plan.

But making no decision is still making a decision. If you have no estate documents, not only have you made it likely that your family will end up in court, but you have also decided that a court will choose your representatives for health and finances. That means your death and state statute will decide your beneficiaries. It might not be the outcome you want, so make the best decision you can for NOW. Making a choice that works for you today, knowing you can change it, is better than doing nothing. If you don’t believe any of your family or friends would be ideal or it would place an undue burden on them, find a professional. But name someone.

One caveat…make sure you check with the person you are naming. Don’t surprise them. They may not want the responsibility, or they may feel like they are not capable of performing the tasks required. It can take a significant amount of time and work. Give them the courtesy of asking.

Why to prepare documents now, update frequently

Let’s assume that you have overcome the challenge of drafting your initial documents. That is a huge accomplishment so congratulations! But an estate plan is not a “set it and forget it” kind of thing.

Deciding who will have the time, the ability, or the desire to act on your behalf when the time comes isn’t always easy and sometimes a person you thought would be perfect turns out not to be so perfect. Their life may have changed, their health may have changed, they may have moved. You may no longer have the relationship you once had with them. If he/she is a professional fiduciary, attorney, or CPA, they may have retired. For these reasons and more, you need to review your estate documents every 3-5 years or anytime there has been a significant life change for you, one of your beneficiaries, or one of your fiduciaries.

Over the years, I have been hired by people who originally named siblings who have since begun to lose capacity, who named spouses or parents who have since passed away, who named children who no longer get along, who named grandchildren who didn’t want the responsibility, who named friends who have moved away or passed away, or who simply didn’t have anyone they thought would be able to manage the responsibility. I have also assisted family members who were named as fiduciaries and were overwhelmed by the tasks required so they needed an extra hand to sort through it all.

Make your best choice now

Don’t let a judge decide who makes your health care decisions or who manages your estate. Review in 3-5 years, or sooner, if life has brought changes to any of the parties involved and continue to review regularly. An up-to-date estate plan is a huge gift for your family and friends. It can avoid sending your family to court when they are already struggling to deal with your illness or death.

If you don’t have family or friends who are well-suited to take on these roles, seek out a professional who is. Ask them about their experience and vet them well. For financial duties, ask if they have had a background check, and choose someone you feel sure would carry out your wishes. (Note that all members of AADMM have had background checks.) You can do a search on the AADMM website and find members who provide fiduciary services in your area or ask your trusted professionals such as your financial advisor or estate attorney for recommendations.

Caitlin Hall is a Certified Daily Money Manager (CDMM®), former board member of AADMM, and founder and president of Organize My Life Daily Money Management in Fort Lauderdale, Florida.

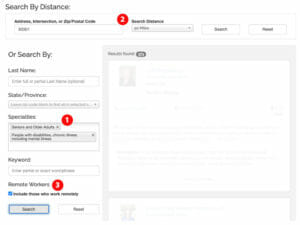

How to find a Daily Money Manager

You can search our member database to find a Daily Money Manager that will act as a fiduciary.

1. Select specialty:

- Fiduciary

2. For onsite services, select geographic area

3. For offsite or remote services, check:

Include those who work remotely